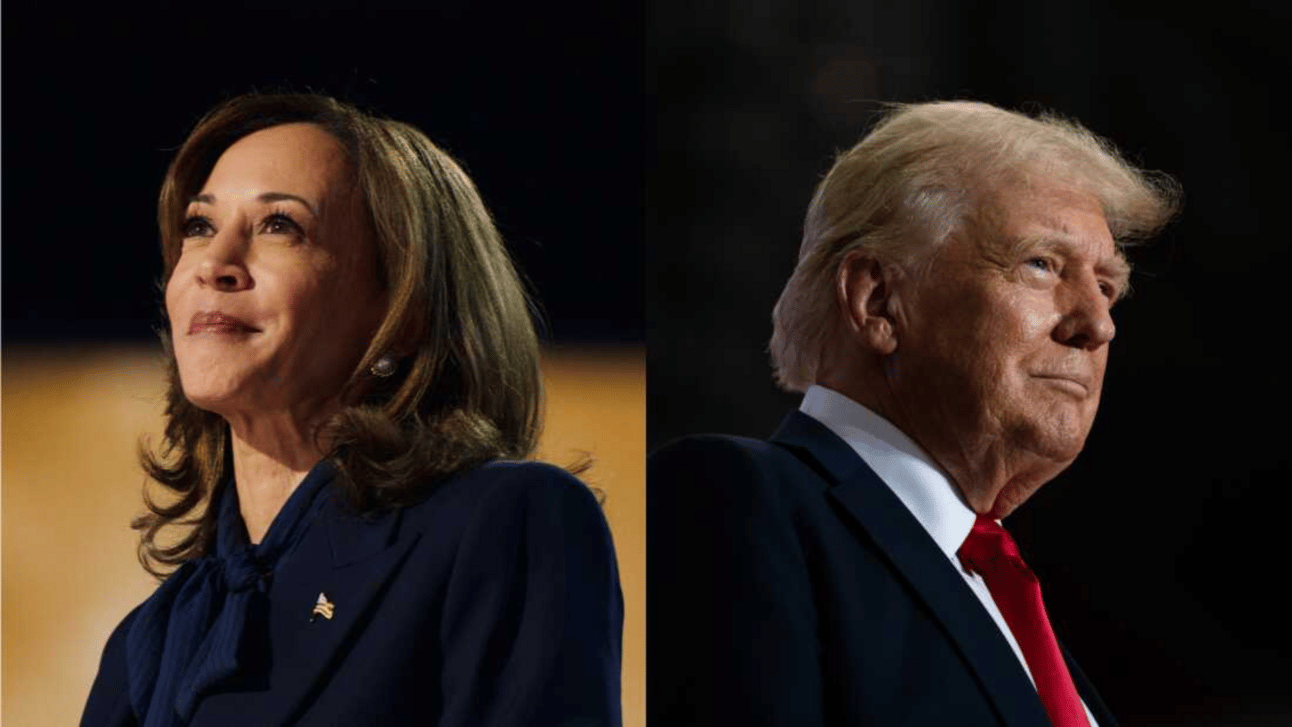

Image: NPR

The presidential election is 28 days away, and there’s ongoing discussion about the future of the Inflation Reduction Act’s Home Energy Rebates and HVAC-related tax credits — depending on who wins.

💰 Home Energy Rebates

What’s happening: The Inflation Reduction Act (IRA) allocated $8.8 billion for two programs, managed by each state, that provide consumer rebates for energy-efficient upgrades.

As of October 7, six states have launched, fourteen have been approved, and seven more await approval.

If Harris wins: While the Vice President hasn’t outlined specific energy policies, she continues to praise the IRA, which she cast a tie-breaking vote for in 2022.

It’s unlikely that a Harris administration would meaningfully scale back the IRA.

“Democrats would ‘see any efforts to cut back on the IRA as a poison pill, unless we're really talking tweaks around the edges,’” S&P Global noted.

If Trump wins: The former president, on the other hand, has made it clear that if elected, he’ll put the IRA under a microscope; however, he hasn’t publicly commented on the Home Energy Rebates.

💰 Tax Credits

What’s happening: The IRA extended the Section 25C tax credit, giving homeowners a credit of up to $3,200 a year for energy-efficient home improvements, including $2,000 for heat pumps.

If Harris wins: Kamala Harris has not specifically addressed the Section 25C tax credit or clarified whether she’d extend the TCJA.

Harris’s campaign didn’t respond to Homepros’ request for comment.

If Trump wins: Donald Trump has said he’d extend the cuts but hasn’t disclosed how he’d pay for them.

“It’s likely that hard choices will be necessary… there’s popular philosophy on the Hill that targeted tax incentives should be sacrificed to preserve lower individual and corporate rates,” said ACCA’s Sean Robertson.

“[S]everal tax incentives like Section 25C have been discussed as possible pay-fors for extending tax changes,” Ayers added.

Yes, but: Everything, of course, depends not only on who’s in the White House but also on which parties hold majorities in Congress.

The bottom line: The next 28 days, and the following year, will certainly be interesting.

Editor’s note: We’ll provide updates on these topics as they occur.

📫 To get stories like this delivered to your inbox every week for free, subscribe to our newsletter here.